Our Mission

“Nurturing a disciplined culture of money management skills towards financial independence” with F.I.R.E. Strategy using time tested financial tools

The F.I.R.E. Movement

F.I.R.E. = Financial Independence Retiring Early

Financial Independence (FI) means that you have sufficient savings (or passive income-generating assets) and do not depend on a regular job to take care of your expenses. In a nutshell, you never need to work again. We believe that financial independence is about being free to live your life in pursuit of happiness.

Retiring Early (RE) means that you have enough money to retire, and you are free to do whatever your passion is and live the dream lifestyle that you always wanted.

“Retired doesn’t mean not working or not earning anymore”

What is the problem we faced today?

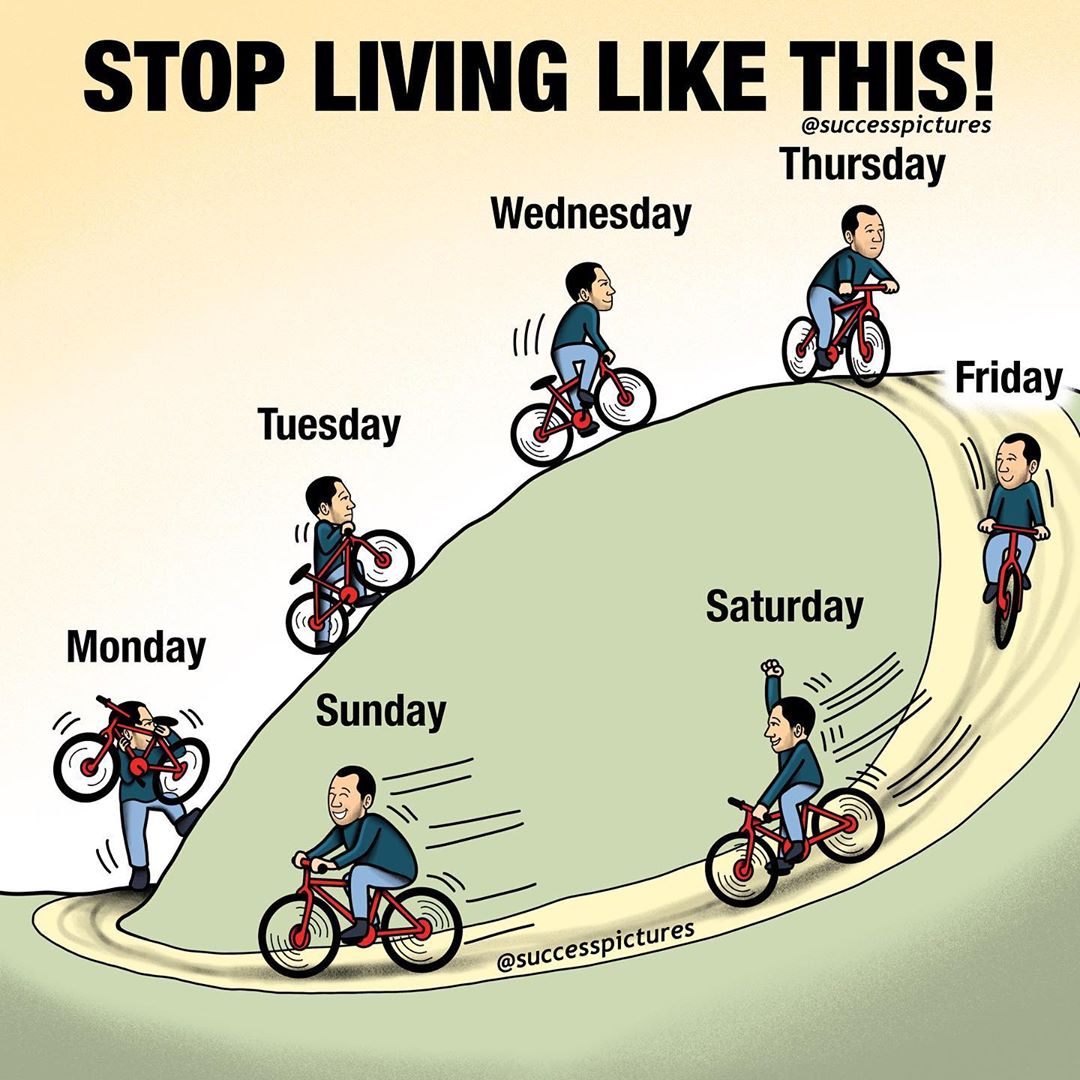

Chances are, most of us are in this rat race. We work a minimum of 8 hours a day, sometimes more, and not consider the stressful traveling time that comes with the job. This never-ending pattern continues, day after day, week after week, and then years have gone by without you realizing it. It continues because you believe that you are financially incapable of stopping working. But the good news is, YOU CAN.

We are sure that you have spent sleepless nights worrying and agonizing about your personal finances, commitments, debt obligations, children’s education, and many other financial-related matters. However, it is about time to break free from these nightmares and move towards a world where your personal fortune is revered.

If only our school system has an elementary financial education system in place, we would have been in a much better position to improve our personal financial skills. Personal finance is a necessary life skill, as a lack of financial knowledge has dire and painful consequences. Due to the lack of financial literacy, numerous people have ended up in financial distress and uncertainty. In our adulthood, one can see that finances are understandably one of the leading causes of stress that keeps you awake at night.

The burning question to you is, are you ready to take this step to equip yourself with the right financial knowledge and skills to fulfill your dream lifestyle.

What does retiring early means?

For most of us, retirement meant never having to work again for the rest of our lives. But with the FIRE movement, Retiring Early offers you the ability to pursue a quality lifestyle you have dreamt of without any concern, as your financial requirements are taken care of.

The success factor of FIRE lies in the concept of building a passive income stream that never depletes your principal financial sum (initial capital) for the rest of your life. So essentially, taking total financial control of your life allows you to fulfill that ideal way of life.

Many from the FIRE community have first started exploring new opportunities that they never know were possible. Early retirement has allowed them the beauty to unlock a new career of choice or starting a business, which they discovered to be very passionate about.

“ The best feeling in the world is GETTING PAID TO DO WHAT YOUR LOVE. “

Honestly, I have personally achieved it; with comprehensive financial computation and prudent planning. I retired early at the age of 43, leaving a highly successful but extremely stressful job with a 6-figure paycheck. Although I was earning much lesser initially, I have never regretted that decision for many of the immeasurable benefits of that move. My quality of life has been improved drastically, with more quality time to spend with my family and the opportunity to pursue things that matter. – FC Hong

Why are we doing this?

In the “From Rat Race to F.I.R.E.” course, we detail the reality and stumbling block hindering many from achieving Financial Independence. Unfortunately, the reality is most people are in the rat race today, and it seems literally impossible to escape from this stressful and never-ending cycle. However, you can break out of this cast with the FIRE strategy, as it will guide you to identify the most workable and achievable path towards financial independence in the shortest possible time.

Right now, we are in a vulnerable stage and could be much worse off during these challenging economic times. So it is only logical that you must start to prepare planning for your financial future. But therein lies the problem; many do not know where and how to start.

Unbeknownst to many, the path to financial independence is fairly straightforward. However, we believe that the critical failure can be summarized by the inability to consistently follow through, progress tracking, monitoring, and financial reviews based on the current fast-changing financial and economic circumstances.

How are we doing it?

Our first objective is to help you understand why it is critical to put your financial house in order. After which, you will embark on a journey to master and achieve total financial independence.

You will be utilizing our financial tools, which clients have used with a net worth of hundreds of millions in the past decade. The tools have the ability to run multiple scenarios based on the different inputs and variables to calibrate and align the most justifiable outcome.

These steps aren’t any earth-shattering discovery or a magic formula. It begins with a simple proven single step that you can start now that enables you to focus on short-term planning. During the course, you will learn how to compute your FREEDOM NUMBER and design a roadmap to your financial independence. As time passes, you will gain traction and develop medium and long-term plans that include enhanced economic simulations.

One can expect that the financial journey will be long and challenging. It can also be detailed, tiresome, and drudgery. Rest assured that we have the structure to support you with the relevant financial know-how, guidance, and mentorship to usher you ahead of the game.

Who is this for?

As the course is designed using a question-based approach, it is simpler to follow through, especially for those determined to take affirmative action to learn how to improve their financial well-being.

This course is for those who seek to leave the mad rat race and start a rewarding financial journey.

It is for those who dream of doing what they love to do all day, every day, without any worry about money.

It is for those who never want to wake up to the sound of the alarm.

It is for those that want to relieve themselves from the biggest worry about retirement — whether you will have sufficient money to live through your entire retirement.

At the end of the day, the change will have to start with you. There will be sacrifices to take and efforts required to achieve financial freedom. We can and will hand-hold you through this journey, but you are the only one who can make that difference.

Grab the Pre-Launch

Discount NOW!

Question & Answer

All the typical questions most potential students would ask!

- Passion to learn simple steps to master your financial destiny.

- Have proper disciplines to follow the steps to financial independence.

- Basic Microsoft Excel skill.

- Laptop or desktop with Wi-Fi.

- Zoom Account – Require For Online Coaching/Mentoring Session.

- People who are worried about their financial problems and can’t seem to find workable solutions to their problem.

- People who wants to retire early.

- People who wants to be successful in life and be in total control of their money.

- People who wants to reduce your debts level

- Those that wants to master the art of money management.

- Learn the secret to financial management.

- Setting out achievable financial goals.

- Learn to track and monitor all your money.

- Debts reductions techniques.

- Using the right tools for proper financial planning.

This online course is conducted in iLearnFromCloud.com, where it is one of the most reputable online teaching platform! After your purchase, you will able to access to the videos online through the platform anywhere and anytime!

This online course is hosted in iLearnFromCloud.com, so the payment method is Stripe or Credit Card. Don’t worry about the payment security, make sure you only process the payment at iLearnFromCloud.com platform in order to access to your course. So no worry!

Introducing One-On-One

Financial Coaching Session

3 Stage Coaching Model

How does the One-On-One Session benefits you?

Provides Clarity And Direction To Your Financial Position

The first thing we are going to do is understand your financial goals. Each session will use the necessary tools and tracking mechanism to ensure that all your financial position is clearly defined, track, monitor, and evaluated.

Provides Unbiased Feedback & Support

Our focus is on providing true and honest feedback, free of any biased third-party input that we will present to you to make a sound financial decision. We will firmly put you back on track when you have swerved astray from your financial goals.

We hold you Accountable & Be process driven

After a while, many of us tend to lose motivation easily, have trouble prioritizing, have limiting beliefs, or get distracted by the in’s and out’s of life. We will help steer you back on track if and when you falter or when financial circumstances change.

Note: our will conduct all coaching and mentoring session with the strictest confidentiality.

We reserve the right not to accept any coaching/mentoring session if we cannot offer any positive solutions/recommendations/options. The first thing we do is conduct a preliminary survey after signing up for the session. We will refund your fees to you immediately.

Please ensure that you have taken "From Rat Race To F.I.R.E." before signing up for the Coaching/Mentoring Session.

The opinions expressed on the website and information provided by the coach/mentor are for general informational purposes only.

Click here for our coaching program.

are you ready?

Work With Me

FC Hong - MBA, CFP

FC Hong has more than 35 years of experience with more than 25 years in a senior management position with many leading IT and outsourcing companies in Malaysia.

He has developed a straightforward, no-nonsense approach to viewing the business first and then relating technology to address the company’s true objectives (short and long term).

One of the key corporate achievements was during the 1997 financial crisis. He was leading a team of more than 400 staff. Armed with strong people management skills and problem resolution strategy, he overcame all the challenges that the company faced without any staff retrenchment, a staff pay cut, and most critical was exceeding the company revenue expectation.

Now, he is sharing those valuable experiences, challenges, and pitfalls while working hand in hand with you to solve your personal, financial, and business problems.

During the session, he will offer insights, encounters, and feedback to which he can use to adapt to your situation.

Personalized Session

FINANCIAL COACHING SESSSION

- Completed - From Rat Race To F.I.R.E.

- Pre Coaching Survey.

- 1 Online Session - Fact-Finding and Interview.

- 2 Online Session (45 minutes each).

- Free Personal Budget Tracker

- 90 days access to Basic Version - ePlan System

RM1699.00

FINANCIAL MENTORING SESSION

- Completed - From Rat Race To F.I.R.E.

- Completed Coaching Session.

- 1 Online Session – Set up, Fact-Finding and Interview (45 minutes)

- 3 One-To-One Online Strategy Review Session.

- 1 Year Access - Professional Version - ePlan System

RM4999.00

Financial Management workshop

- 1 Pre Workshop Survey, Fact Finding & Interview.

- 1 Day Online Session - 3 breaks

- Max - 5 pax

- Free Bonus - From Rat Race To F.I.R.E.

- 90 days access to Basic Version - ePlan System